The insurance industry, where products have traditionally been distributed though intermediaries, faces a challenge; how to use customer analytics to enrich the user experience and increase the lifetime value of the customer and channel relationships.

The issue is the disconnect between products providers, distribution channels and customers, and the lack of a single customer view. The solution is a dynamic ‘customer centric’ marketing platform that can adapt to multi-channel distribution and provide real time data analytics and marketing.

Many corporations will find that customer data is their main asset, and the opportunities to harness data within financial services companies are amongst the highest for any industry, whether selling direct to customer, or though channel partners.

Once companies are set up to leverage their real-time data signals, an endless array of opportunities and spin-off applications present themselves:

Creating intelligent customer insights from ‘data exhaust’ and customer market interactions to maximize the lifetime ROI of the customer and channel partner. Millions of customer interactions tracked & analysed in real time to deliver relevant, timely, two-way dialogue. Algorithms can deliver real time content, web pages, new and relevant product offerings based on purchasing history and behaviour. Personalised web pages (portals) provide unique one-to-one customer experiences based around interests and sales opportunities.

Complex sales processes and forms created on the fly with automated data mapping to simplify the user experience. Closed loop data capture continuously learns customer preferences to increase ROI.

So how do you go about setting up a system that continuously learns and responds dynamically to customer and market opportunities? And more important how do you provide one-to-one marketing and sales processes to millions of customers, across multiple channel partners, brands, products and states, each with their own legal and compliance issues?

The solution comprises of four parts: 1. A sophisticated independent database that aggregates, collects and analyses real time customer behavior and data from all customer and market interactions, including Web, email, SMS, Call Centre, channel partner, social media etc. 2. A marketing engine that uses algorithms and configurable rules to trigger fully automated sales and marketing communications products collateral, and even processes. 3. A content database where all marketing collateral, rich media, video, compliance, rules and processes are contained and updated. 4. A business process integration engine that allows information to be passed between Stream and third party tools to support through processing, policy issue, premium calculations, and screen flow.

The central ‘hub’ that integrates all of these components is an intelligent database, independently managed and hosted for the financial services provider, which integrates and enhances, rather than replaces, exiting systems.

A more effective solution than traditional CRM is to create individual web portals (PURLs) for each client, which dynamically update content and processes for each customer, integrating with Call Centers and advisers where help is needed. These portals become the focal point for the client and the relationship, containing existing purchases, collateral and educational material, as well as new product ideas, with rich context specific media that enhances the cross-sell and up sell opportunities, working 24/7 365 days a year. Each portal is based around customer profile, interests and needs, and may have context specific video, calculators, educational material, and products, with different call centers and advisers.

Distribution is a major issue for most companies and the rationale behind many mergers and acquisitions, particularly in financial services. The challenge is leveraging sales, particularly when faced with multiple business units, brands, products and customer groups often across multiple, disconnected, and legacy databases.

Web technology offers a new and radical distribution and cross-selling solution. It is now possible to open new distribution channels through collaborative marketing in a completely secure, data protected environment. For instance, AIG market their insurance products though 800+ own-branded affinity web sites across the USA, representing many millions of customers, with the branding, compliance and processes automated to provide a seamless, personalized 24/7 customer sales experience, which would be possible to maintain without the technology behind it.

Take for example example a bank and an insurance company who wish to cross-sell selected products to each other’s 15m combined customers. Many historical issues have been around trust, compliance, brand, compounded by legacy systems, integration and data security. In fact, even after merger or acquisition the merged entities often continue to operate as independent business units with little or no crosssales. New cloud-based technology can facilitate cross-selling, allowing hitherto disparate information to be collated, analyzed and profiled and personalized ownbranded products to be delivered to customers completely seamlessly. Each company retains full control over their brand integrity, the marketing material and the sales process.

The result is a true win/win-double the potential customers and a huge increase in sales at virtually no cost!

The experience is seamless for the customer and secure for the marketer, and raises the question: Why buy distribution when web-based data marketing data systems can achieve better results, with greater control, at much lower cost?

For financial services, where compliance is an integral component, data and process driven rules can be used to dynamically create and pre-populate branded application forms, consent wordings, underwrite, and process applications using e-signature. The result is a scalable marketing solution that measures, learns, and replicates the functions of a knowledgeable sales advisor without the cost, whilst allowing human contact at any time. Most important, the system retains a full audit trail, which can guarantee compliance, even when marketing multiple products to millions of customers across multiple states with different legal requirements. The result is reduced cost, higher customer ROI, and a better customer experience.

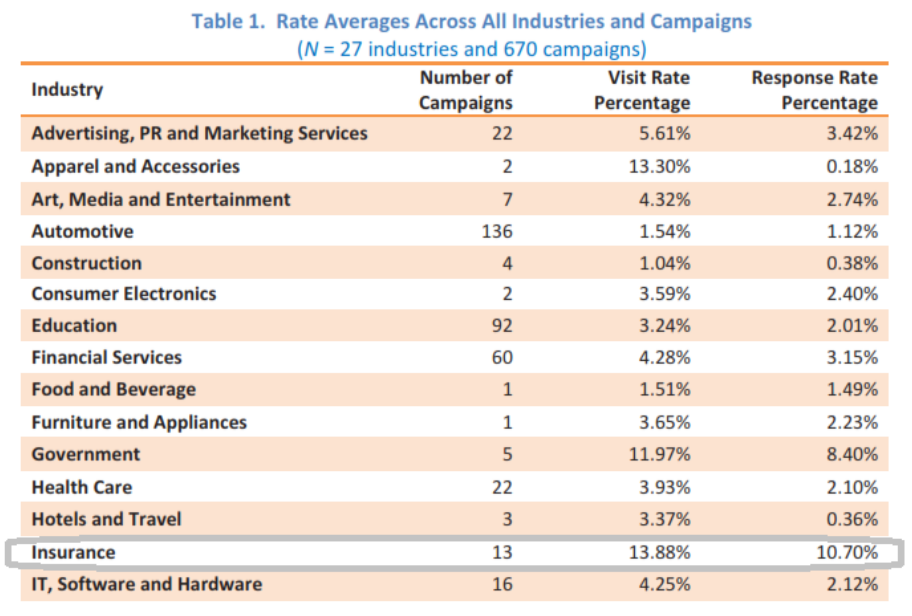

The insurance sector shows the highest response rate across all industries for personalised marketing.

Capture and intelligent use of customer and market data is key.

Personalising the customer experience leads to increased sales, and higher customer lifetime value. New technology allows this to be done seamlessly and easily.

Afinium Corp’s innovative software increases the lifetime value (ROI) of customer relationships and channel partners by analyzing and interpreting ‘real time’ customer data to develop insights, steer and influence customer behavior and sales.

The software has been created by experts in marketing, data analytics, and technology, with huge domain experience in financial services, gaming, and consumer marketing across multiple industries. Deep domain experience gives Afinium Corp a significant competitive advantage when engaging with clients and channel partners. The software can interpret and understand individual behavior and preferences, and instantly steer the conversation or transaction, using a combination of predictive signals and rules based processes. Afinium Corp’s unique ‘closed loop’ customer approach allows continuous measurement of ROI, and can deliver millions of personalized marketing campaigns and interactive customer communications concurrently, including context based Video, Call Centre, email, SMS, and even individual web portals.

Afinium Corp’s belief is that all marketing and communication and relationship management centers around the individual, so the communications, content, and preferences need to be personalized and be able to respond immediately to sales and market opportunities before they are lost.

Robert J Paterson

| Afinium Corp DD: +44 20 8133 8446 | M: +44 7780 445 842 |

US: +1 347 688 8912

e: Robert.paterson@afinium.com

www.afinium.com

Jim Ouimet

e: jim.ouimet@afinium.com

t: 00 1 (0) 215 862 3080

m: 00 1 (0) 703 862 5715

Afinium Corp (USA) , 403 Greenwich Court, New Hope, Pennsylvania, USA, 18938